Discover the Best Cheyenne Credit Unions: Trustworthy and Trustworthy Financial Services

Discover the Best Cheyenne Credit Unions: Trustworthy and Trustworthy Financial Services

Blog Article

Unlock the Conveniences of a Federal Credit Rating Union Today

Check out the untapped benefits of aligning with a government lending institution, a calculated economic move that can transform your financial experience. From exclusive participant perks to a solid community values, federal cooperative credit union provide a distinctive technique to economic services that is both economically beneficial and customer-centric. Discover how this alternate financial version can offer you with an unique perspective on monetary wellness and lasting security.

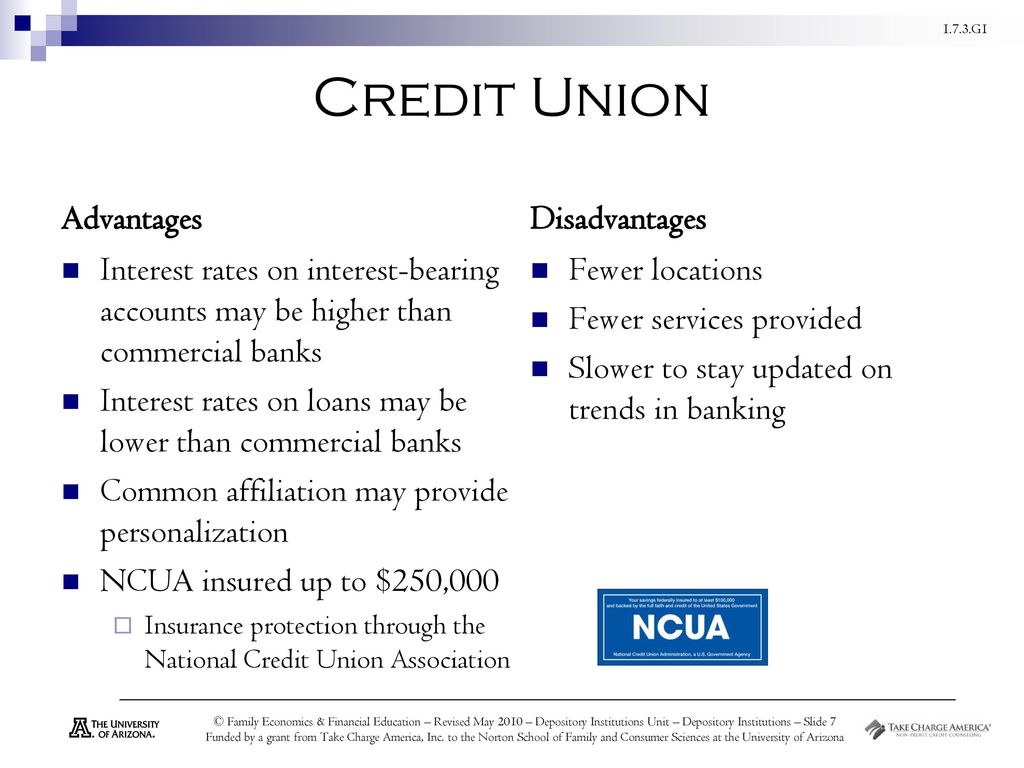

Advantages of Joining a Federal Credit Scores Union

One of the primary advantages of joining a Federal Credit scores Union is the emphasis on participant contentment rather than generating profits for shareholders. Furthermore, Federal Credit rating Unions are not-for-profit organizations, enabling them to offer competitive rate of interest prices on cost savings accounts, finances, and credit report cards (Cheyenne Credit Unions).

An additional benefit of signing up with a Federal Lending institution is the feeling of neighborhood and belonging that participants frequently experience. Cooperative credit union are member-owned and operated, suggesting that each participant has a stake in the organization. This can promote a feeling of loyalty and trust fund in between members and the Lending institution, leading to an extra tailored financial experience. Last But Not Least, Federal Lending institution frequently provide financial education and learning and resources to aid members improve their monetary literacy and make notified decisions concerning their cash.

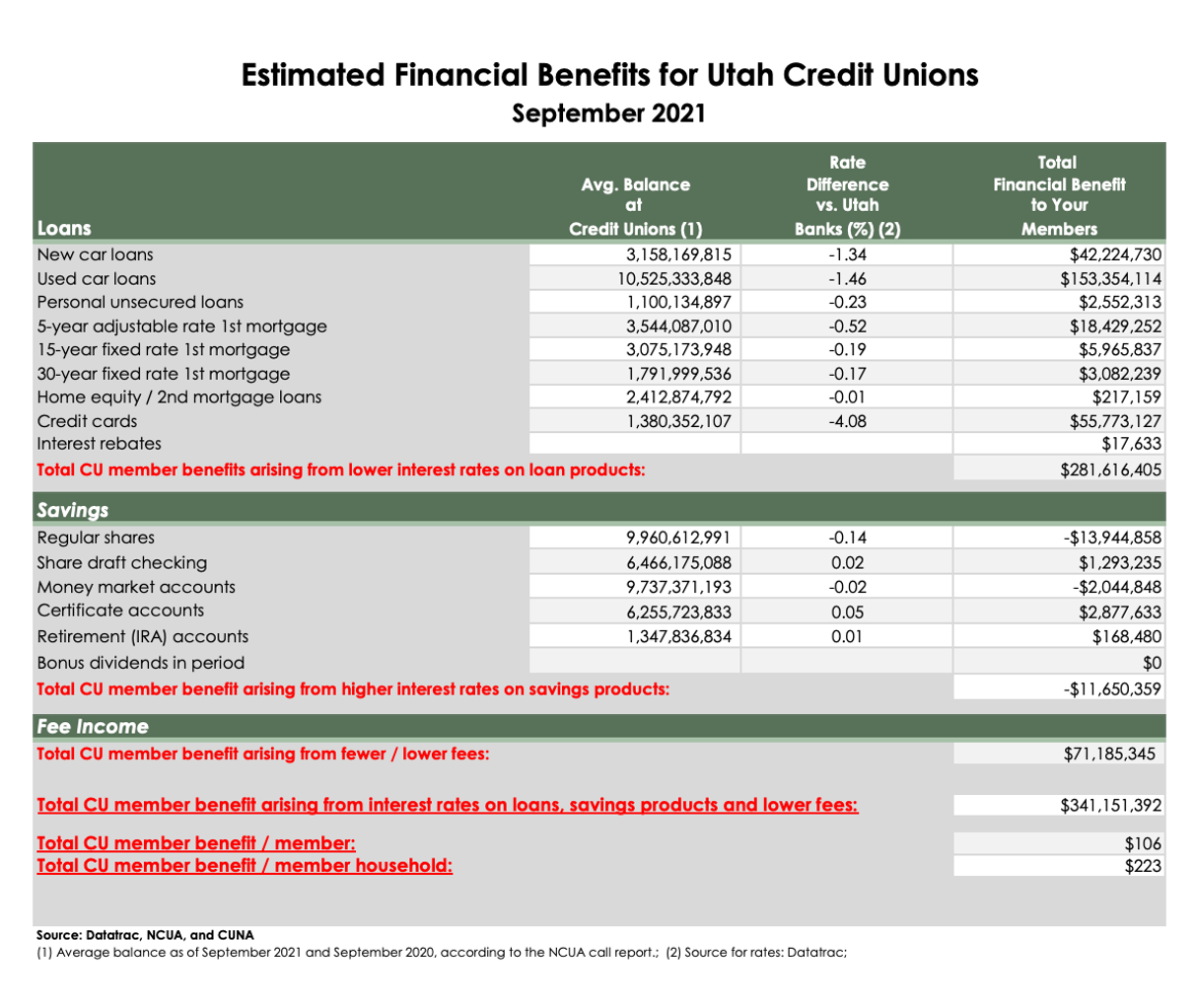

Lower Charges and Affordable Rates

In addition, federal credit scores unions are recognized for providing competitive passion prices on financial savings accounts, finances, and credit report cards. By providing these competitive rates, federal credit scores unions focus on the financial health of their participants and make every effort to assist them accomplish their financial objectives.

Customized Client Service

A hallmark of government cooperative credit union is their dedication to providing personalized customer care customized to the private demands and preferences of their members. Unlike traditional banks, federal lending institution focus on building solid relationships with their participants, aiming to offer a more tailored experience. This personalized method means that members are not simply viewed as an account number, but rather as valued individuals with distinct monetary objectives and scenarios.

One method government credit scores unions deliver customized customer care is with their member-focused technique. Agents take the time to understand each participant's particular economic circumstance and deal customized services to satisfy their demands. Whether a member is looking to open up a brand-new account, request a funding, or look for financial advice, government credit unions make every effort to offer tailored support and support every action of the method.

Community-Focused Initiatives

To better boost their influence and link with participants, federal lending institution actively engage in community-focused campaigns that contribute to the health and growth of the locations they offer. These initiatives frequently include monetary education programs intended at encouraging people with the expertise and abilities have a peek here to make educated choices about their funds (Credit Unions Cheyenne). By using workshops, workshops, and individually counseling sessions, cooperative credit union aid area participants boost their economic proficiency, handle financial debt efficiently, and prepare for a safe and secure future

Furthermore, government lending institution regularly take part in neighborhood events, enroller community projects, and assistance philanthropic causes to attend to specific requirements within their solution areas. This involvement not only demonstrates their dedication to social obligation however also reinforces their partnerships with participants and fosters a sense of belonging within the area.

Via these community-focused campaigns, federal lending institution play an important duty in promoting economic addition, financial security, and general prosperity in the regions they run, ultimately creating a favorable effect that expands past their traditional banking services.

Optimizing Your Subscription Benefits

When wanting to maximize your membership advantages at a debt union, comprehending the selection of resources and solutions available can significantly boost your financial health. Federal lending institution supply a series of benefits to their participants, including competitive rates of interest on savings accounts and loans, lower costs compared to typical financial institutions, and individualized customer support. By making the most of these benefits, members can improve their economic stability and attain their objectives better.

Furthermore, taking part in financial education programs and workshops given by the credit scores union can aid you enhance your cash management skills and make more educated decisions about your monetary future. By actively involving with the resources offered to you as a member, you can unlock the full Visit Your URL possibility of your relationship with the credit report union.

Final Thought

To conclude, the advantages of signing up with a federal cooperative credit union include lower costs, affordable rates, individualized customer care, and community-focused initiatives. By maximizing your membership advantages, you can access expense savings, tailored solutions, and a feeling of belonging. Consider opening the benefits of a federal cooperative credit union today to experience a banks that prioritizes participant fulfillment and provides a range of sources for economic education and learning.

Furthermore, Federal Debt Unions are not-for-profit companies, permitting them to offer competitive rate of interest rates on financial savings accounts, financings, and credit score cards.

Federal Credit report Unions usually supply monetary education and resources to help members improve their financial literacy and make educated choices concerning their cash.

Report this page